How to Analyze Exchange Rates for Dollar Buy Sell Advantage

Idea to Enhance Your Experience With Dollar Get Offer Opportunities

Guiding dollar buy-sell possibilities calls for a strategic technique. Understanding market trends is necessary, as variations can considerably impact money values. Timing transactions wisely can result in far better results. Additionally, utilizing different currency exchange platforms can improve effectiveness. However, it's crucial to evaluate danger aspects and set practical goals. By thinking about these elements, investors can improve their end results and experiences. What other methods might better improve their approach?

Understanding Market Trends

Recognizing market patterns is vital for making informed choices in currency trading. Investors evaluate different indicators, such as economic data, geopolitical occasions, and market belief, to gauge the instructions of money activities. Identifying favorable or bearish trends permits traders to take advantage of on potential chances, optimizing earnings while decreasing threats.

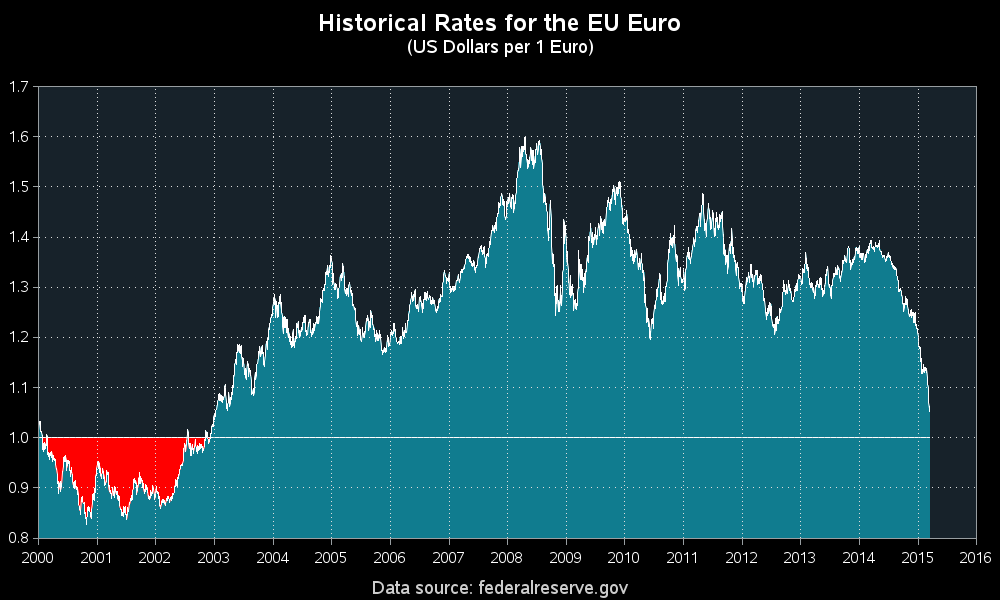

Technical evaluation plays a substantial role in recognizing these trends, including the research study of price graphes and historic data to forecast future movements. Traders commonly use tools like relocating averages and fad lines to recognize patterns. In addition, staying informed concerning international economic problems, such as rate of interest modifications and rising cost of living rates, can offer valuable insights into currency changes.

Timing Your Deals

How can investors successfully time their deals to maximize profits? Timing is essential in the buck buy-sell market, as changes can substantially influence returns. Investors ought to closely keep track of financial indications such as rate of interest, rising cost of living, and employment data, as these usually determine currency movements. Furthermore, comprehending market view can supply understandings into possible rate shifts, enabling investors to place themselves advantageously.

Utilizing technological evaluation can likewise help in timing choices. Traders might look for patterns or signals, such as relocating averages or assistance and resistance degrees, to recognize excellent access and departure points. Setting informs for key cost levels can ensure that traders remain informed regarding market modifications without continuous tracking.

Being mindful of geopolitical occasions, such as elections or profession arrangements, is necessary, as these can lead to unexpected fluctuations in currency worths. Ultimately, a tactical approach to timing can enhance earnings margins in buck buy-sell chances.

Using Money Exchange Platforms

When taking part in currency exchange, picking trusted systems is important for successful purchases - Dollar Buy Sell. Recognizing currency exchange rate is just as vital, as they directly affect the value received throughout buy and market opportunities. With each other, these elements can considerably affect overall trading outcomes in the buck market

Choosing Trustworthy Systems

Recognizing Exchange Rates

Understanding exchange prices is basic for investors utilizing currency exchange systems. These prices dictate just how much one money is worth in regard to an additional, directly affecting trading decisions. For effective trading, individuals should keep track of changes influenced by economic indications, geopolitical events, and market belief. Money exchange platforms often provide real-time data, making it possible for investors to make educated selections. Furthermore, recognizing the bid-ask spread is crucial, as it stands for the cost of going into and exiting professions. Traders need to likewise acquaint themselves with various currency sets and their historic efficiency, as this expertise can boost tactical preparation. By understanding these ideas, investors enhance their possibilities of profiting from buck buy-sell chances, inevitably maximizing their earnings.

Setting Reasonable Goals

How can traders set practical objectives in the unstable globe of currency exchange? Establishing attainable targets is necessary to traversing this unpredictable market. Investors need to begin by evaluating their experience level, recognizing that novices might require to go for smaller sized, more convenient earnings. It is advisable to set particular, measurable, obtainable, relevant, and time-bound (WISE) goals that line up with private trading strategies.

Next, traders must consider their risk tolerance and available capital. This allows for setting objectives that are both enthusiastic and grounded in personal financial circumstances. Routinely evaluating and readjusting these objectives in response to market problems can foster a positive method, helping investors continue to be adaptable. Furthermore, keeping a trading journal can assist in tracking progression and refining future goals. By establishing realistic goals, investors can keep motivation and focus while passing through the investigate this site intricacies of buck buy-sell possibilities.

Evaluating Danger Elements

Liquidity levels can impact the implementation of trades, triggering slippage throughout high volatility periods. Investors must additionally understand leverage ramifications, as it can intensify both losses and earnings. Performing extensive analysis and applying danger monitoring methods allows investors to browse the intricacies of dollar buy-sell chances successfully, promoting an extra enlightened trading experience. Understanding these danger elements is essential for making sound investment choices in the vibrant forex market

Staying on top of Economic Indicators

Recognizing essential financial indications is essential for any individual aiming to make enlightened decisions in buck trading. By examining market trends and understanding international financial occasions, traders can better expect fluctuations in money value. Remaining upgraded on these variables can considerably improve one's ability to recognize buy and market opportunities.

Trick Economic Indicators

As market characteristics continuously change, staying notified regarding essential economic indicators becomes crucial for anyone associated with currency trading. These indicators function as crucial tools for reviewing the total financial health and wellness of a country and can greatly influence currency values. Secret indications include Gross Domestic Product (GDP), unemployment rates, inflation actions such as the Consumer Rate Index (CPI), and passion rates set by main banks. Modifications in these metrics can cause changes in money strength, affecting buy and market decisions. Additionally, trade equilibriums and manufacturing information additionally provide understandings into financial efficiency. By keeping track of these indicators, traders can make more informed decisions, improving their strategies in the competitive landscape of dollar deal possibilities.

Market Patterns Evaluation

To efficiently browse the complexities of money trading, investors must analyze market patterns while staying attuned to financial indicators. Recognizing the connection between why not look here fads and economic information is important for making notified decisions. Traders ought to check crucial signs such as GDP development, rising cost of living prices, and employment figures, as these can signify shifts in money value. By observing historic patterns and present market activities, investors can recognize prospective access and departure points. Utilizing technical analysis devices can additionally enhance their insights, highlighting price levels and fads. In addition, remaining updated on reserve bank plans and geopolitical developments can offer context for market fluctuations. In final thought, an extensive approach to market patterns evaluation is essential for successful trading in dollar buy-sell opportunities.

Global Economic Occasions

International economic occasions substantially affect money markets, making it critical for traders to remain informed concerning major financial signs. Key signs consist of GDP growth rates, joblessness numbers, rising cost of living data, and customer confidence indexes. These metrics offer insights into financial wellness and can motivate changes in currency worths. For circumstances, a surge in GDP frequently signals a strong economic situation, potentially reinforcing the buck. In addition, central financial institution plans, affected by these indicators, play an important function in money valuation. Investors need to check scheduled statements and records for possible market influences. By staying upgraded on these financial signs, traders can make informed choices, enhancing their techniques in dollar buy offer chances and navigating the unstable money landscape effectively.

Often Asked Concerns

What Prevail Pitfalls to Avoid When Purchasing Dollars?

Typical pitfalls to avoid when acquiring bucks include not researching present exchange rates, stopping working to compare several sources, ignoring surprise costs, and impulsively purchasing without taking into consideration market patterns or individual economic objectives.

Exactly How Do Geopolitical Occasions Affect Buck Purchases?

Geopolitical occasions greatly affect buck deals by changing market security, impacting Website capitalist confidence, and causing changes in currency exchange rate. Discontent or plan modifications can bring about enhanced need or supply discrepancies in buck money.

Can I Establish Alerts for Buck Price Changes?

Yes, people can establish notifies for dollar price adjustments with different economic platforms and applications. These informs notify users of substantial changes, making it possible for prompt choices in trading or deals based on market movements.

What Resources Can Assist Me Track Buck Trends Better?

Different monetary news websites, mobile apps, and broker agent systems supply real-time graphes, market analysis, and specialist commentary. Economic indicators and money exchange reports likewise provide important insights for tracking dollar trends efficiently.

Exist Tax Effects for Currency Trading Profits?

Yes, money trading revenues typically have tax ramifications (Dollar Buy Sell). Investors may require to report gains as funding gains or ordinary earnings, depending upon their scenarios, requiring careful record-keeping and consultation with tax professionals for compliance